Dear friends,

February is a fraught month, historically. For Romans, it once did not exist. And then it did, as the last month of the year, with the new year beginning when the crops were first sewn and all eyes looked to the future. Februalia, the festival of purification, was the last chance to put the misdeeds of the past behind us and to be prepared to build a future upon a solid foundation.

It’s also the month in which Augustana launches its Spring semester; as I ponder the snow piles on campus, I could imagine a more vernal moment for the start.

In the Chinese lunisolar calendar, 2024 is the Year of the Dragon with New Year’s celebrated on February 10. The Dragon is the only mythic being in the Chinese calendar. It is the most propitious of all years. Brilliant, relentless, and bold, they follow the Year of the Rabbit. Timidity, doubt, and hesitation are supplanted by growth and good fortune.

But 2024 is not represented by just any Dragon. The heavenly branch is for the Wood Dragon, a symbol of the Imperium. Of all its kindred, the Wood Dragon alone thrives on humility. Generous and compassionate, honorable and loyal, they do not wield that vast power as dictators. Power flows from them, a gift freely given to the wise. Good people are drawn to the Wood Dragon, not quite knowing why but sensing the aura of health and hope that surrounds them.

And so, we’ll offer a word or two on purification (of my portfolio, at the least) and another few on optimism and generosity.

In this month’s Observer …

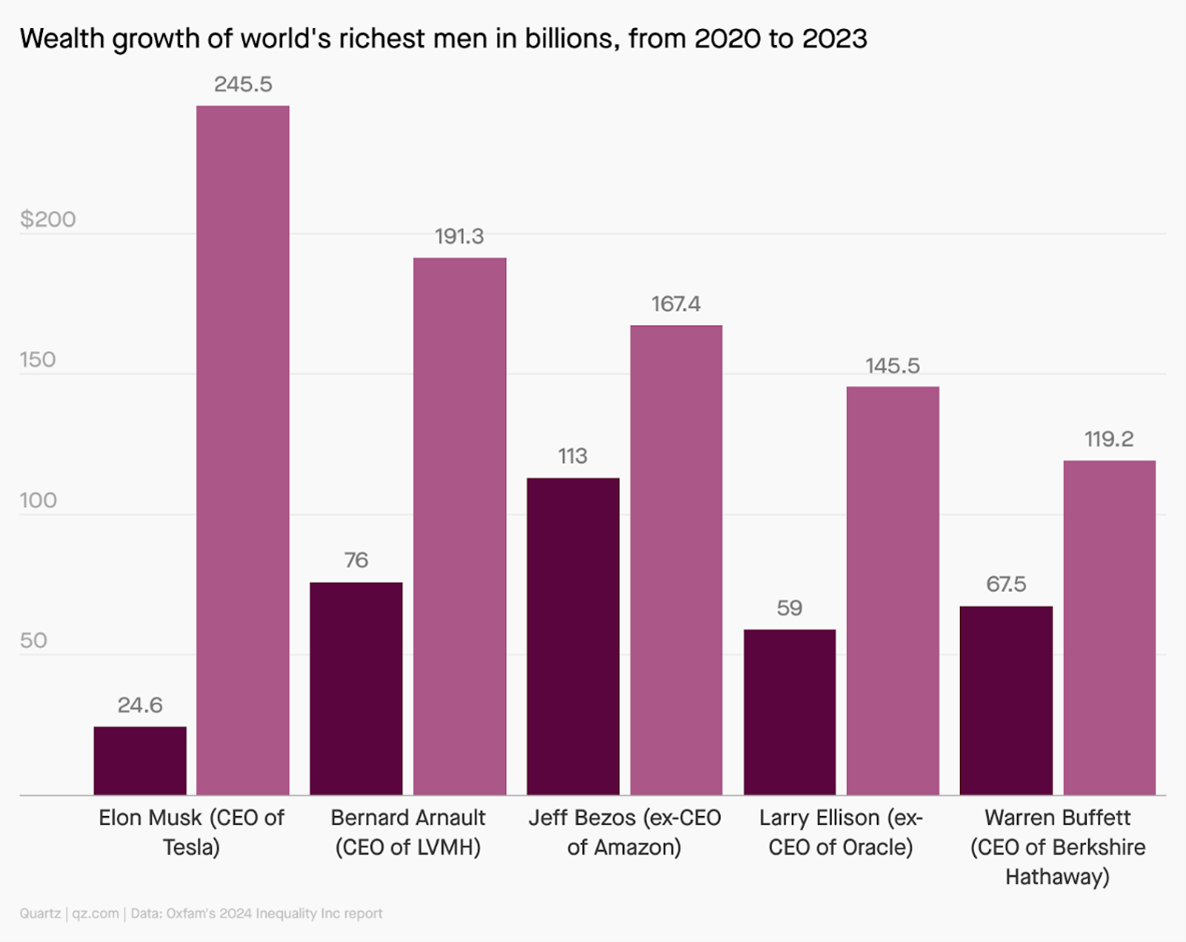

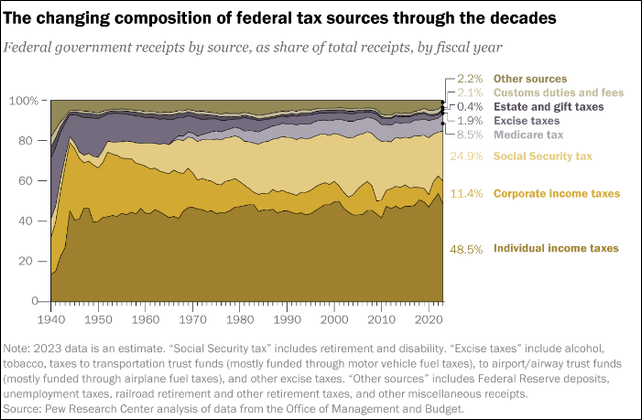

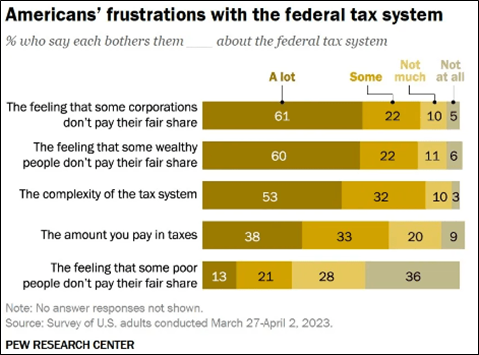

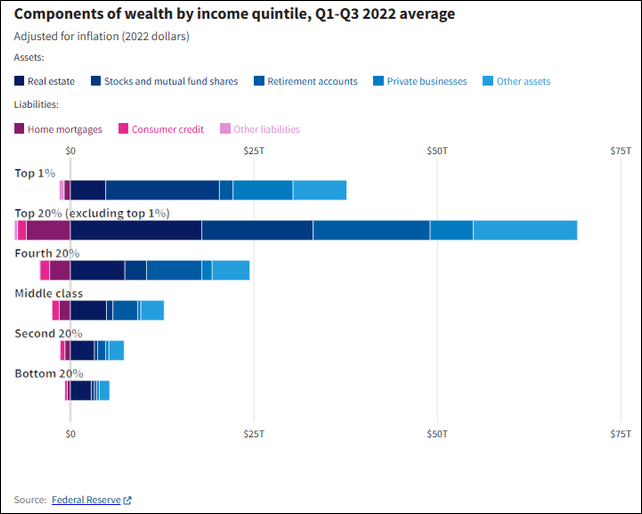

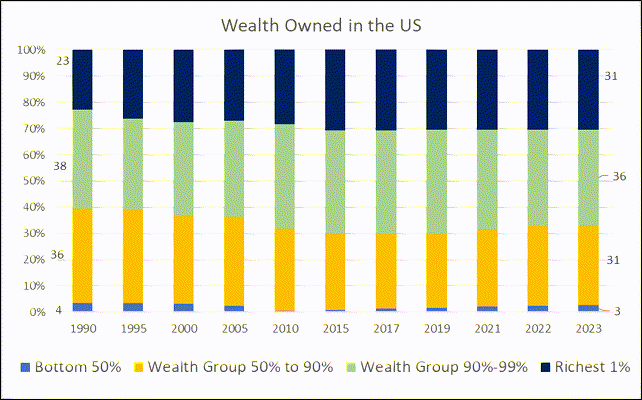

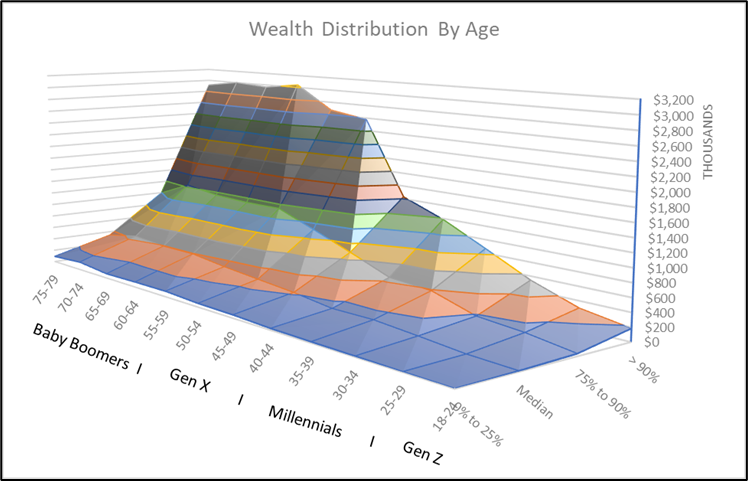

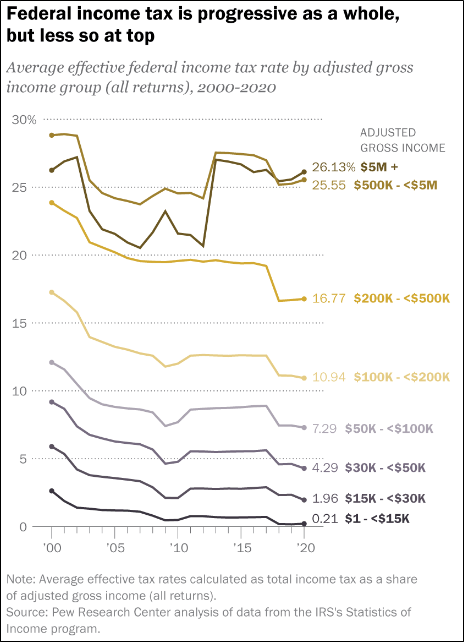

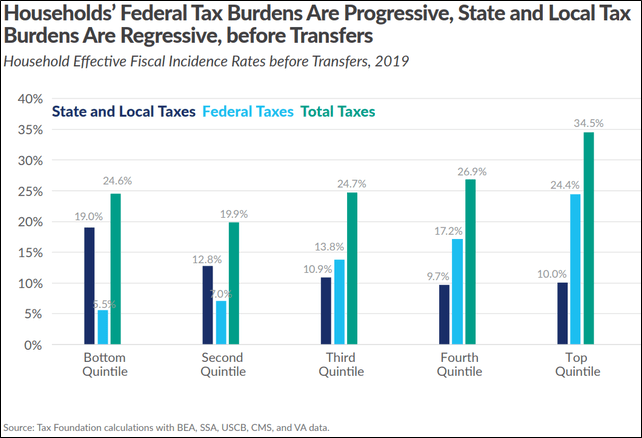

Lynn Bolin takes on the conventional wisdom, fed by 2023’s unconventional market, that the 60/40 portfolio is a relic of the past. In a distinctive essay, he steps back to think about the appeal of “The Patriotic Millionaires.” They’re a group of 200 or so high net-worth individuals who have committed unusual acts of patriotism: “raising the minimum wage, combatting the influence of big money in politics, and advancing a progressive tax structure.”

I share three pieces for your delectation:

In celebration of the National Football League’s annual player awards, MFO recognizes the Offensive Player and Rookie of the Year, the Defensive Player and Rookie, the Comeback Player, and the Most Valuable Player in the fund world.

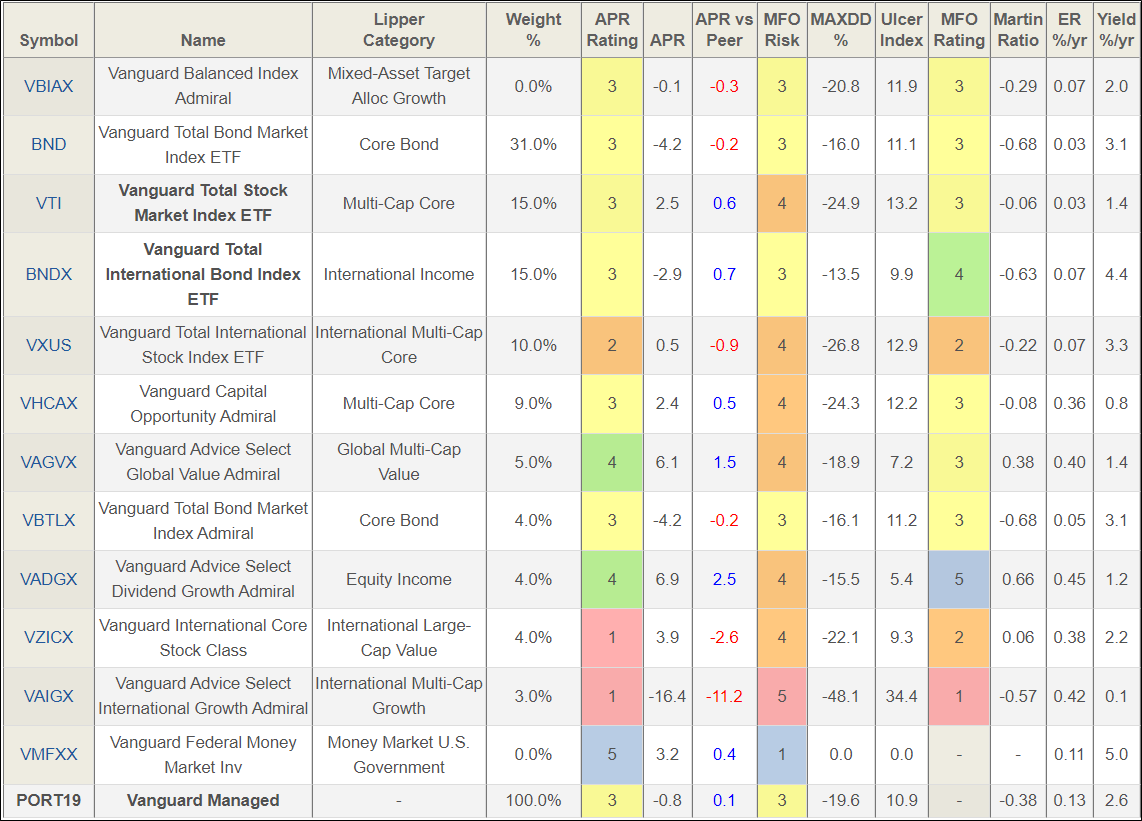

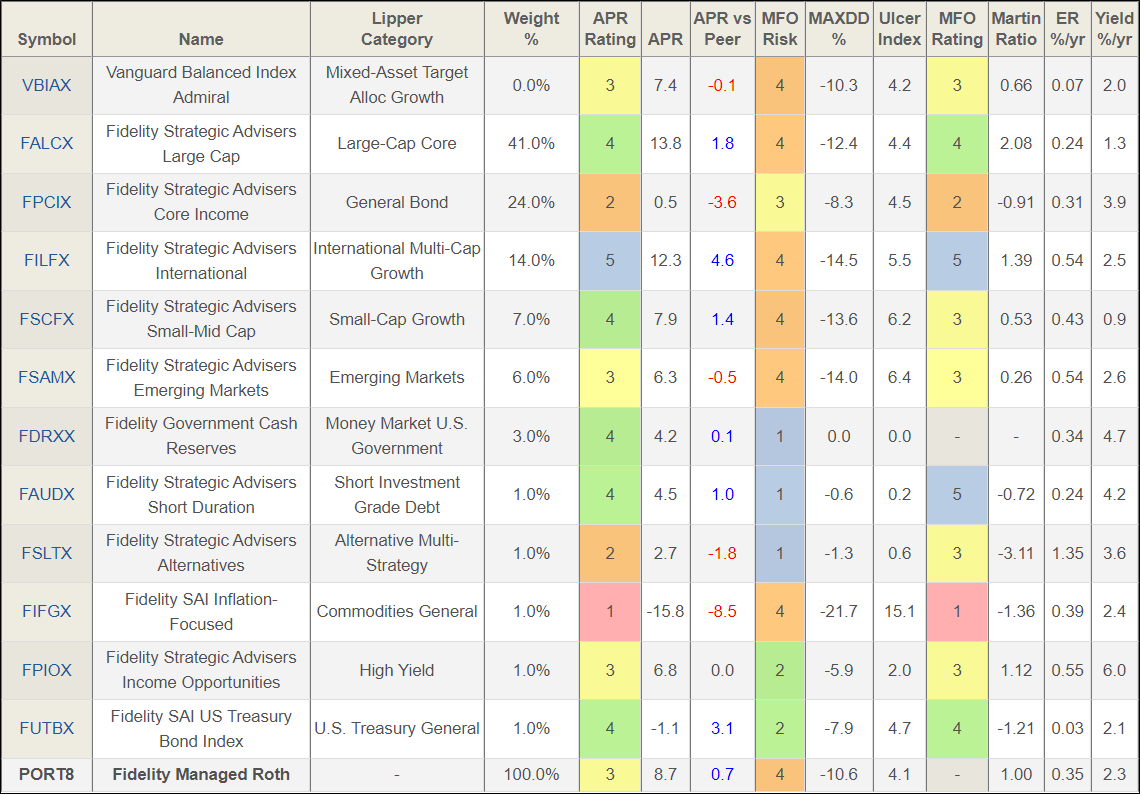

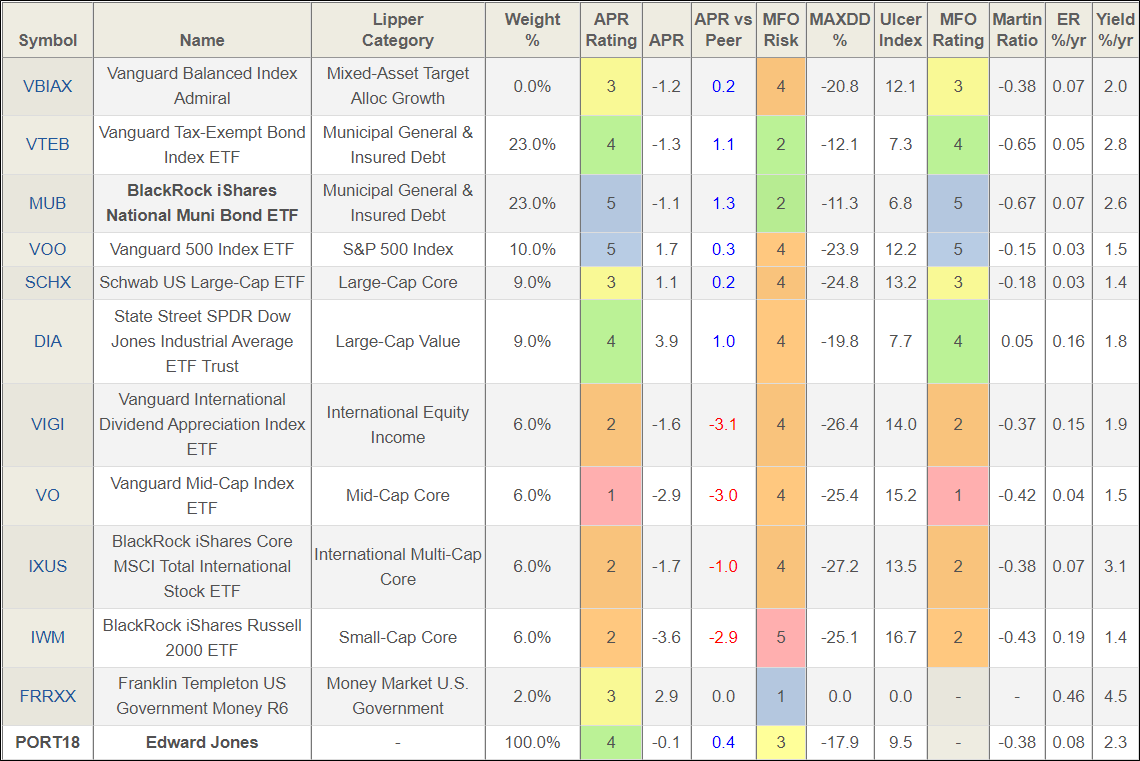

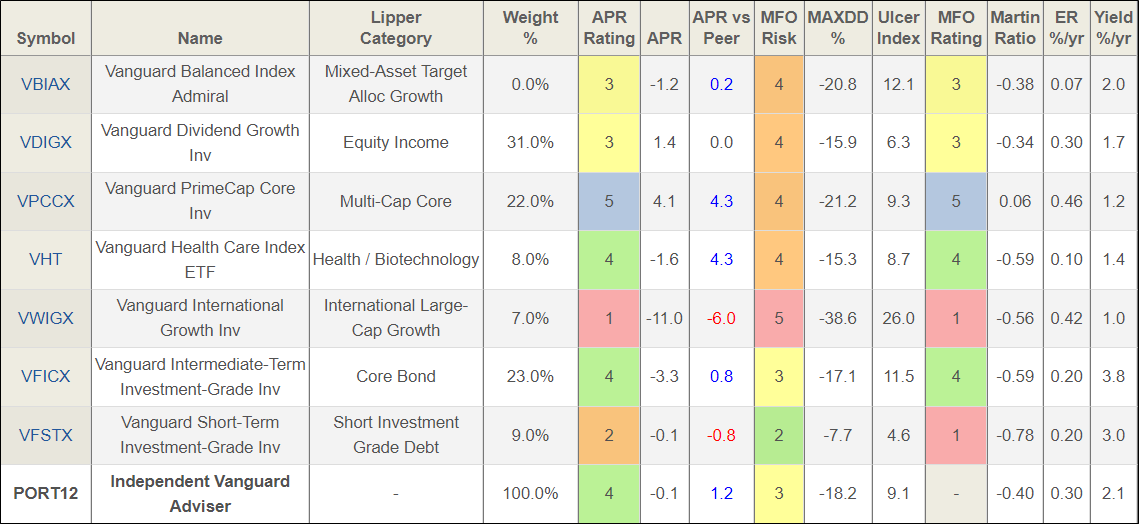

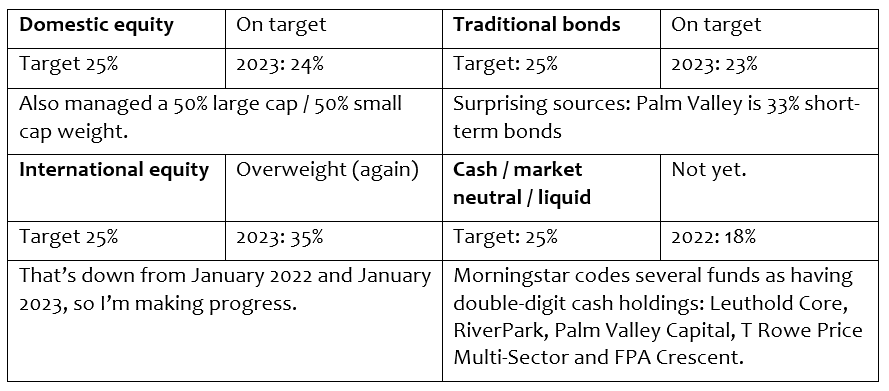

In celebration of nothing at all, I share a quick analysis of the state of my own portfolio: its goals, structure, status, and evolution. It’s an annual event.

Finally, Augie’s January Term allowed me to teach just one course for the month: one set of 18 students meeting with me for three hours a day, five days a week. No committee meetings. No other classes. No department events. The freedom from multi-tasking was surprisingly liberating, and I found myself learning a bunch of new stuff without intending to. And so I’ve shared my gleanings.

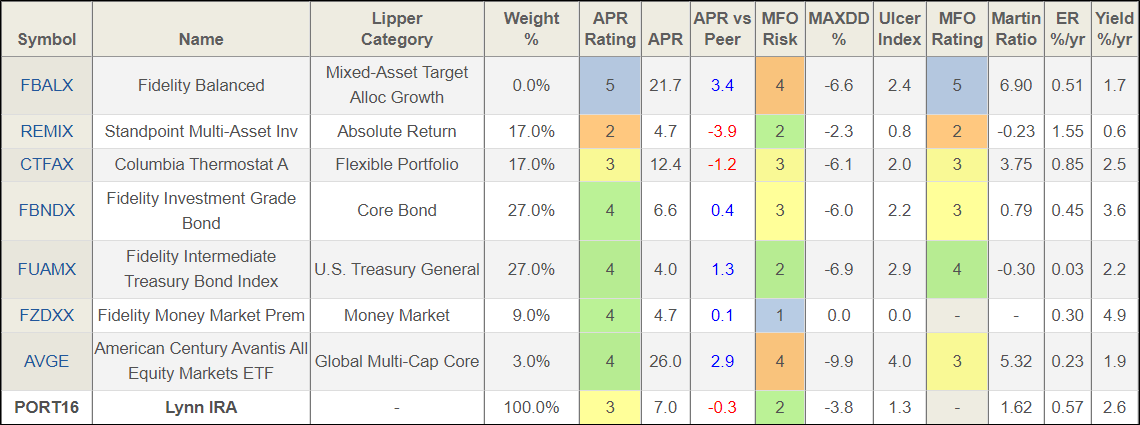

In the spirit of February, Devesh Shah also shares his portfolio review.

The Shadow shines a light on the industry’s maneuverings including new services from Vanguard, the decline of Matthews International, and a whole host of fund disappearances.

Rondure beyond Overseas

Rondure Global Advisors announced the closure and liquidation of one of its two funds, Rondure Overseas. The liquidation is slated for 8 February 2024. The decision to liquidate Overseas struck me as both wise (on the advisor’s part, given the financial reality of underwriting a tiny fund) and sad (because the fund, except in ’23, did exactly what we might hope for: double digit returns in good years, protection in bad ones).

For those who don’t know her, founder/chair/portfolio manager Laura Geritz began her investing career at American Century where she was a global analyst. In 2006 she joined Wasatch Funds as the founding manager for the Wasatch Frontier Emerging Small Countries Fund, and lead manager for both Wasatch International Opportunities Fund and Wasatch Emerging Markets Small Cap Fund. She founded Rondure in 2016 and continues to manage the four-star Rondure New World Fund. In 2023, she made the rare, brave, and principled move to hand off the CEO and CIO responsibilities to others. While she has roots in Kansas, she has lived in Japan, speaks Japanese, and reads cool stuff. Across years and markets, she has been remarkably successful in serving her investors. She and her team are deeply invested, financially and otherwise, in their funds.

For those who don’t know her, founder/chair/portfolio manager Laura Geritz began her investing career at American Century where she was a global analyst. In 2006 she joined Wasatch Funds as the founding manager for the Wasatch Frontier Emerging Small Countries Fund, and lead manager for both Wasatch International Opportunities Fund and Wasatch Emerging Markets Small Cap Fund. She founded Rondure in 2016 and continues to manage the four-star Rondure New World Fund. In 2023, she made the rare, brave, and principled move to hand off the CEO and CIO responsibilities to others. While she has roots in Kansas, she has lived in Japan, speaks Japanese, and reads cool stuff. Across years and markets, she has been remarkably successful in serving her investors. She and her team are deeply invested, financially and otherwise, in their funds.

I’ve spoken with Ms. Geritz on several occasions: at the launch of Rondure, for a profile of Rondure Overseas, and then again in January 2024 when we chatted about the liquidation of Overseas as an essential part of the process of growing and strengthening Rondure Global.

Some of the highlights:

- Overseas, even at its peak in performance, never hit its stride in the market. The fund’s expenses outstripped its revenues, which meant they had to divert resources from areas where they had confidence and saw opportunities.

- Their portfolios were pretty solid in 2023, but they missed one major opportunity: Taiwan. Rondure looks for the intersection of quality and value, and Taiwan offered both. They hesitated primarily because they suspected that much of Taiwan’s corporate gains were driven by the post-pandemic revenge spending / work-from-home trade, which was unlikely sustainable. By many measures, corporate performance did deteriorate, but corporate share prices still soared to a 40% gain in 2023.

- China is offering some intriguing possibilities, with many firms selling for less than the value of their cash and other assets. Those are the so-called “net-net” companies where you’d still have a profit if they simply liquidated the day after you bought them; the money they make going forward is icing or gravy or some similar food metaphor. All of which is embedded in “a complete nanny state where power trumps economics.”

- Having moved from devoting lots of time to the corporate side of the firm, Ms. Geritz has freed up time to do the stuff she’s passionate about: investing and building an investment team.

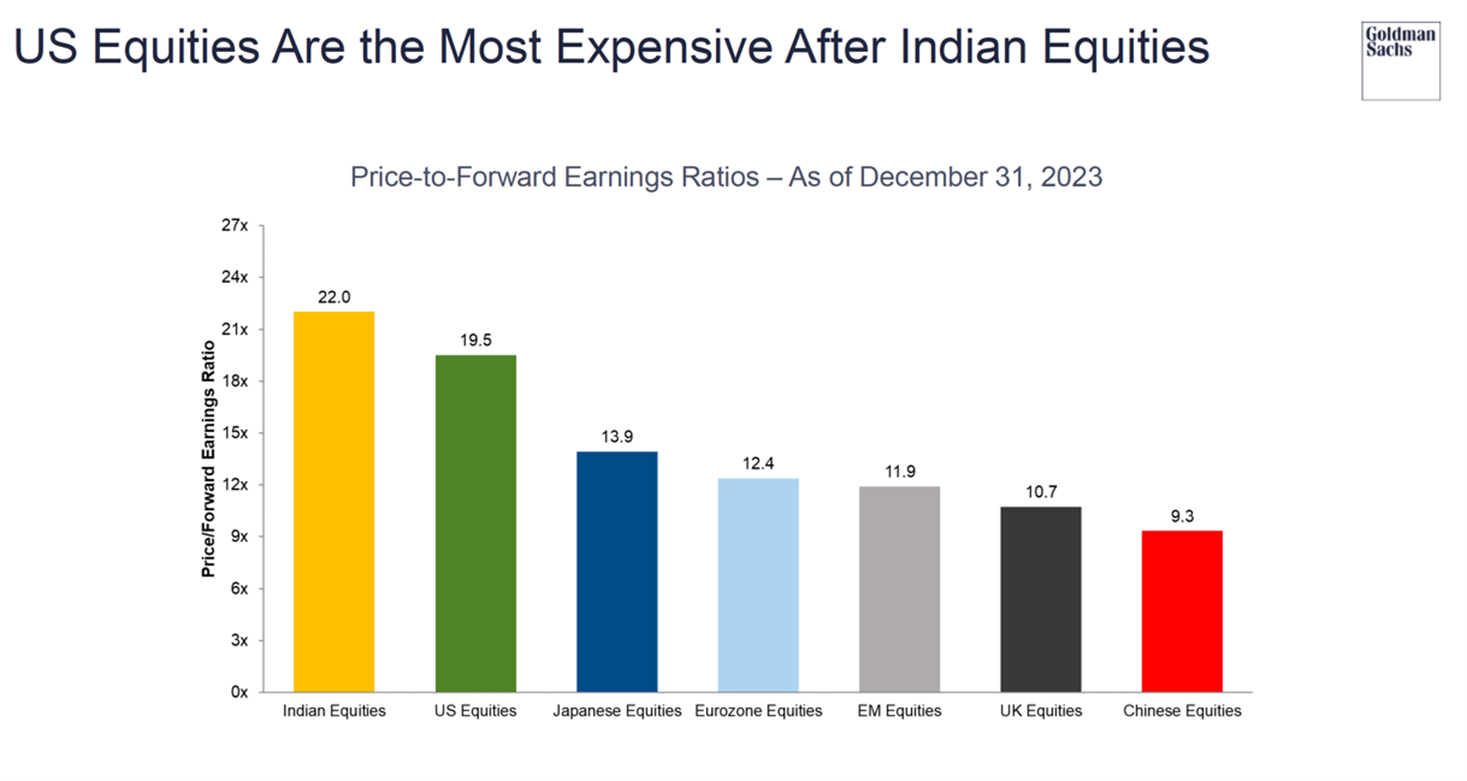

- She sees “a valuation gap between EM and developed markets (especially the US) that has never been wider … We also see catalysts that could charge emerging markets stocks, including a weakening of the US dollar and peaking US interest rates.”

- The firm is adding analytic capacity and is looking, in part at the finance program at UC-Irvine, to add one or two remarkable new colleagues.

- Knowing my interest in reading, she recommends that I read the novel Snow Country by Yasunari Kawabata. Unless she said Snow Country Tales: Life in the Other Japan by Bokushi Suzuki, which is quite a different matter. My scribbled notes had a hieroglyphic vibe at this point, so I’ll likely declare it a twofer!

I have been reading, though slowly, Annie Duke’s book Quit: The Power of Knowing When to Walk Away. At base, Duke argues that we mythologize dogged determination and fail to notice how very often the failure to say “Well, that’s not working out, let’s do something smarter” leads to calamity. (You might enjoy paging through Barbara Tuchman’s The March of Folly: From Troy to Vietnam which is not her best work but which really highlights the cost of refusing to step back.) And, Duke argues, we understudy and undervalue quitting … aka “resource redeployment.” She writes:

Quitting a course of action is sometimes the best way to win in the long run, whether you’re cutting your losses at the poker table or getting ready to climb another day. Decision-making in the real world requires action without complete information. Quitting is the tool that allows us to react to new information that is revealed after we made a decision. Having the option to quit helps you to explore more, learn more, and ultimately find the right things to stick with. (22)

Celebration!

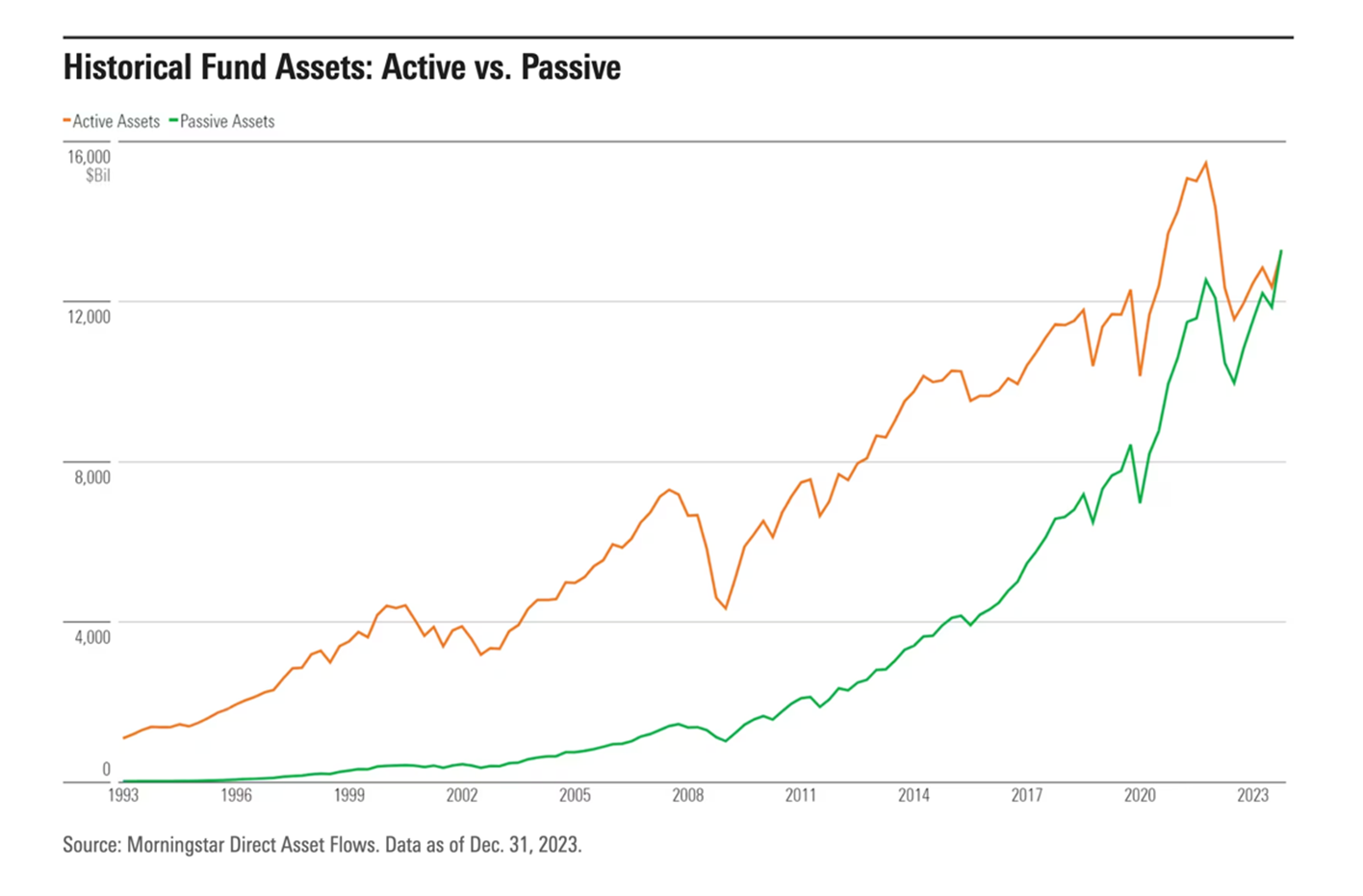

Taylor Larimore celebrated his 100th birthday on January 25, 2024. Taylor is an amazing soul and veteran of the Battle of the Bulge (1944). Dubbed “King of the Bogleheads,” by Jack Bogle no less, Taylor is the long-time champion of the online Boglehead community which embraces the power of low-cost, diversified, passive investing. He co-authored The Boglehead’s Guide to Investing (2e, 2021), edited The Boglehead’s Guide to Retirement Planning (2011), and was selected as one of Money Magazine’s everyday heroes in Champions of the small investor (3/2012). I can say with some confidence that should I live another 100 years, I wouldn’t reach Taylor’s plateau of service.

Taylor Larimore celebrated his 100th birthday on January 25, 2024. Taylor is an amazing soul and veteran of the Battle of the Bulge (1944). Dubbed “King of the Bogleheads,” by Jack Bogle no less, Taylor is the long-time champion of the online Boglehead community which embraces the power of low-cost, diversified, passive investing. He co-authored The Boglehead’s Guide to Investing (2e, 2021), edited The Boglehead’s Guide to Retirement Planning (2011), and was selected as one of Money Magazine’s everyday heroes in Champions of the small investor (3/2012). I can say with some confidence that should I live another 100 years, I wouldn’t reach Taylor’s plateau of service.

Taylor is member #2788 at MFO. From what I can tell, he dropped by in 2018, offered a brief prayer for our souls (and our portfolios), and headed back to saner climes.

We thank Taylor for all he’s done for tens of thousands of small investors and wish him a 2024 full of joy, good health, prosperity, and mischief.

Thanks, as ever …

Old Joe’s profile pic

To Hank and Old Joe, two of the founding members of the MFO discussion board in 2011. This past month each contributed their 10,000th comment to our board.

Crash, at 8100 comments, is on-deck. We cheer his sagacity onward and upward.

Hank’s profile pic

On the whole, OJ seems about as puzzled by Hank’s profile pic as we all are.

And thanks for the coffee cake from Dan (yum! – toasted in the fry pan with a little butter), Chip doles a bit out to me each day. Thanks, too, to Donald from Seattle, Poody (who, like me, wants to learn Premium search tools!), Allen of Georgia, Wayne from Starkville, Amruta of Missouri, a very generous Anonymous (many thanks!), Andrew from Akron, Matthew of Nebraska, Ian from Brentwood, John of PA, and Marty from the Tar Heel State (we’re past COVID for now, thanks for the good wishes, and we’ll share a bit more about assets than about our political leaders).

And, as ever, our Faithful Regulars: Wilson, S & F Investment Advisors, Gregory, William, the other William, Stephen, Brian, David, and Doug.

As ever,

Who will be the NFL MVP? The money is on Lamar Jackson of the Baltimore Ravens, declared “undeniably one of the most electric players in the league.” The 27-year-old had a passer rating of 102.7 with 3,678 yards, 24 touchdowns against seven interceptions, and played in all 16 games. He was magical. (At least until he faced the Steelers against whom he sports a 1-3 record or got to the playoffs.) For his accomplishments, he earned a quarter-billion-dollar contract.

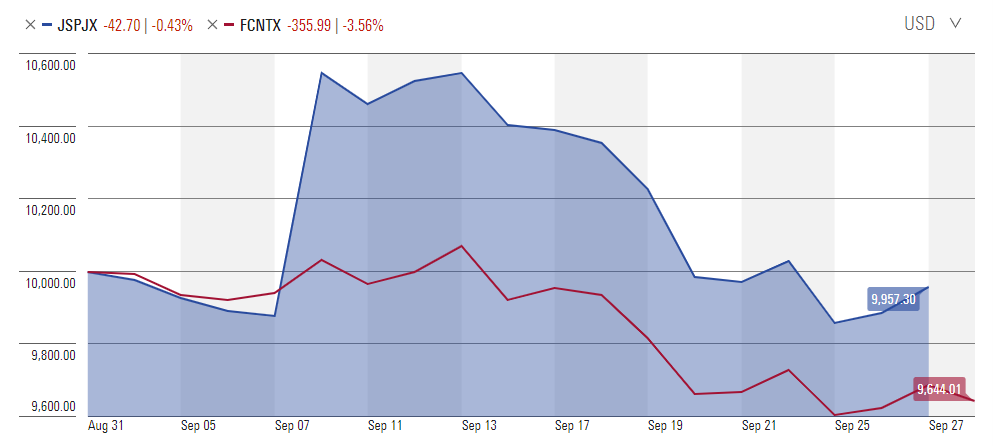

Who will be the NFL MVP? The money is on Lamar Jackson of the Baltimore Ravens, declared “undeniably one of the most electric players in the league.” The 27-year-old had a passer rating of 102.7 with 3,678 yards, 24 touchdowns against seven interceptions, and played in all 16 games. He was magical. (At least until he faced the Steelers against whom he sports a 1-3 record or got to the playoffs.) For his accomplishments, he earned a quarter-billion-dollar contract. GoodHaven Fund

GoodHaven Fund

Finally, we searched MFO Premium for the complete roster of rookie stand-outs. Rookie funds are those with more than one year but less than two years in the league. We screened for rookies who earned their spot on the roster by combining top-tier risk-adjusted returns as well as peer-beating absolute returns. For the sake of simplicity, we separated equity from income funds.

Finally, we searched MFO Premium for the complete roster of rookie stand-outs. Rookie funds are those with more than one year but less than two years in the league. We screened for rookies who earned their spot on the roster by combining top-tier risk-adjusted returns as well as peer-beating absolute returns. For the sake of simplicity, we separated equity from income funds. Our last roster is the Income and Alts Rookie squad. Rookie funds are those with more than one year but less than two years in the league. We screened for rookies who earned their spot on the roster by combining top-tier risk-adjusted returns as well as peer-beating absolute returns. For the sake of simplicity, we separated equity from income funds

Our last roster is the Income and Alts Rookie squad. Rookie funds are those with more than one year but less than two years in the league. We screened for rookies who earned their spot on the roster by combining top-tier risk-adjusted returns as well as peer-beating absolute returns. For the sake of simplicity, we separated equity from income funds